If you notice that a company took money without permission, you have to contact your bank and let them know. However, banks can make errors when posting corrections or companies can make mistakes when debiting accounts. They are fast ways to move money from one account to another and require little work. These incidents occur due to the quick nature of ACH payments. Using Originator Identification Number to Trace Payments A Company Took Money without PermissionĪ business, insurance company or service provider can accidentally take money from your account without permission. It allows the bank to identify the company behind the transaction.

Every time you send or receive ACH payments, this unique ID will be used. Your bank assigns the originator identification number, originator ID, or unique ID to your company. Where Do You Get the Originator ID for Direct Debit? A stop payment will usually last up to 6 months on the account for most banks. It is likely the payment will still go through if the originator use’s another name to withdraw their funds. You will need to provide the bank with the originator’s name, amount of transaction and date of the stop payment. Usually, your bank will allow you to place a stop payment on a pre-authorized debit. You can stop an ACH payment by contacting your bank. There are no ACH transfers that take place on weekends or holidays. They will be posted on the previous working business day or the following working business day. Do ACH Payments Post on Weekends?ĪCH payments and transfers do not post on the weekend. These payments are generally processed three times a day. Most ACH payments and transfers are processed within 1 working business day. If this happens, some banks and mortgage accounts may charge you a $48.00 NSF fee. If you have no funds in the account, the ACH payment will bounce and get returned with no funds. If you make monthly payments for your home mortgage, this is a type of pre-authorized payment. Can ACH Payments Bounce?ĪCH payments and transfers can bounce because of non-sufficient funds. Usually, banks are good at detecting these and they will return/reverse the transfer. When this happens, the funds may arrive in the account of someone else. It is also likely that a name and account number mismatch could occur. An ACH payment/direct deposit can be made in error or in the wrong amount – so, yes they can be reversed.

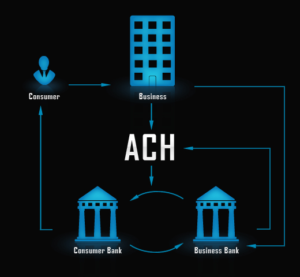

Can ACH Payments be Reversed?ĪCH payments and transfers can be reversed within a specific period of time, depending on your bank. These payments are instant and available in your account as soon as it’s processed. If a credit is made into your account it’s considered an ACH direct deposit. These payroll direct deposits can be in the form of employment income, employer bonuses, government payments, tax refunds, and annuity payments. ACH Direct Deposits and ACH Direct PaymentsĪn ACH direct deposit is a payment that is received by a consumer from an organization, business or government. If you are writing cheques, the costs can quickly add up. Organizations and businesses can use ACH transfers to accept one-time or recurring deposits.ĪCH transfers are a cost-effective PAD or PAC that can help you save money when paying for payroll or accepting vendor payments. You are likely already using a form of ACH payments if you make monthly insurance payments or receive direct deposits. It is an electronic way to safely and securely send/receive money. What is an ACH Payment and How Does it Work?ĪCH payments and transfers allow for the transfer of money between different bank accounts. A Company Took Money without Permission.Using Originator Identification Number to Trace Payments.Where Do You Get the Originator ID for Direct Debit?.ACH Direct Deposits and ACH Direct Payments.What is an ACH Payment and How Does it Work?.

0 kommentar(er)

0 kommentar(er)